Financing Solutions

Flexible financing solutions designed to support your business or personal goals — from loans and credit lines to tailored payment plans, we help you manage your financial needs with ease and confidence.

Financing Solutions Built for You

Access the capital you need, when you need it. From flexible payment plans to customized loan structures, our financing options are designed to support your goals and keep your projects moving forward. Fast approvals, clear terms, and solutions that scale with your needs.

Invoice Financing

Get Paid Faster, Grow Your Business Sooner

Access up to 90% of your invoice value within 24-48 hours. No more waiting 30-120 days for payments

Financing up to 90% of invoice value

Flexible repayment terms (30-120 days)

Competitive interest rates

No collateral required

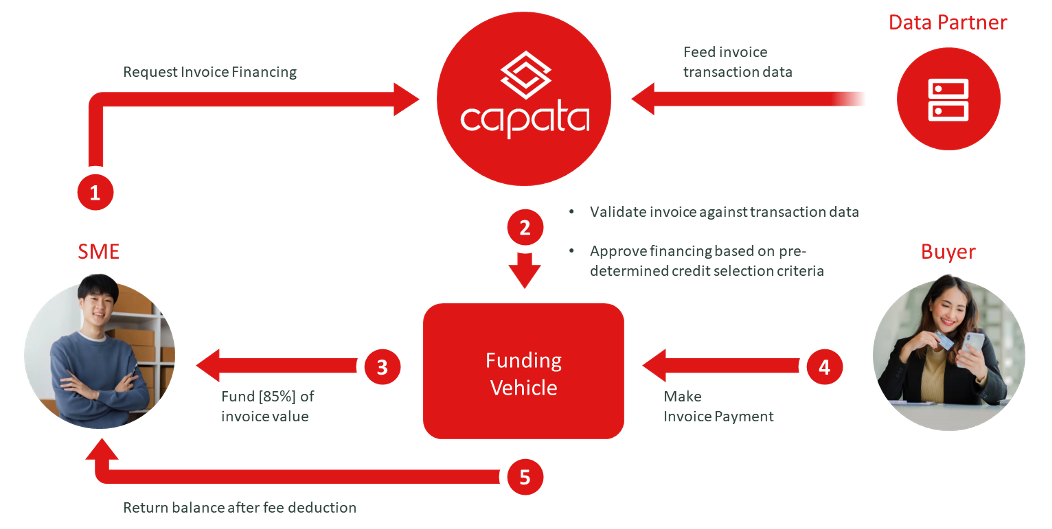

How Does Invoice Financing Work

Invoice Financing allows business to receive payment earlier than the invoice payment terms. This is suitable for SMEs who have a steady stream of recurring invoices.

Estimate your invoice financing interest cost

Use the sliders below to view your estimated figures. Contact us for a personalised quote.

Loan Amount (SGD)

Payment Terms (i.e. Invoice Due Date)

The results from this calculator are for general guidance only and are based on the information you provide. They do not represent a guarantee of the rates you may be offered, nor a commitment to provide financing. Actual rates will depend on various factors, including our assessment of your risk profile. All financing is subject to Capata’s terms, conditions, disclaimers, and lending criteria, which may change from time to time.

How much you could get in advance?

$90,000

When invoices are paid?

$9,055

What are the amount you will pay?

$945

Benefit for Business

Unlock key advantages for your business with solutions that boost efficiency, reduce costs, and support long-term growth.

- Quick Application

- Full Transparency on Fee

- Flexible Structure without Collateral

- Optimize Cash Flow

- Grow Faster with Newly Unlocked Working Capital

- Reduce Reliance on Traditional Banks

Frequently asked questions

- Invoice Financing offered by Capata involves selling your accounts receivable (unpaid invoices) to Capata at a discount in exchange for immediate cash. Unlike traditional loans, Capata offers a more flexible financing solution to purchase your receivables without requiring additional external collateral.

- Yes, in a majority of the cases, the Invoice Financing will be with recourse to the SME business and its owner(s). In practice, under normal conditions, the recourse or guarantee only comes into effect when there is a shortfall on a payment made by a relevant buyer on a batch of invoices.

- Payments made by your buyers will be paid into a dedicated collection account under your name (the supplier's name) but charged to Capata. For each batch of invoices financed, the applicable amounts owed to Capata will be deducted by Capata while the excess cash would be remitted back to your operating account.

- Latest 6 months bank statements

- Director(s) and Shareholder(s) NRIC or Passport and latest CBS report

- Additional documents may be required. This is determined on a case by case basis. Our team will reach out to you once your application is received.

- Fees for Capata Invoice Financing solution typically includes a fixed discount fee, which is a percentage deducted from the face value of your invoices. Other potential fees may include late fee and certain service charges. Capata offers competitive rates. Get in touch to discuss!

- Depending on the arrangement, your customers may or may not be notified. You should assume that your customers will be notified on the financing.